By Todd Condon, Director of Sales in Chicago - New Home Star

Often, the most challenging part of the salesperson's encounter with a prospect is discussing terms. These conversations quickly turn into discussions about loan types, interest rates, APR, price, payments and incentives, none of which reinforce the emotional connection the salesperson has worked so hard achieve for their prospect. Or can it?

Leveraging creative financing solutions can be an extremely effective method during these situations. Becoming well-versed in FHA, VA, and conventional loan types is important and will allow you to sell more homes more quickly.

There's more to this than basic calculations. The successful salesperson knows they must do more than just proposing strategic application of financing to overcome certain payment objections. A few best practices to keep in mind during these objections are as follows:

1. Be familiar with the finance terms and identify opportunities that you can strategically apply to a solution to meet the prospect's specific needs.

2. Know the prospects current monthly payments, their payment expectations for the new home, how much they've saved for a down payment, and if they've previously spoken with a lender. Understanding these elements will help point you in the right direction as you build your strategy and work to close the sale.

3. Calculate the payments on each of the homes listed on your price sheet, including those of your inventory homes, and be prepared to discuss the range of payments for each. For example, if your Brentwood plan reflects a total payment of $1464 per month, you might present this in a payment range of $1450-$1475 and refer them to your lender for specific numbers, rates and terms for which they qualify. Keep in mind, the service you're providing is a necessary estimate to help you close, and you're also setting them up for success when speaking with the loan officer.

4. Leverage the use of your incentives effectively. Many times the prospect will negotiate prices leaving little, if any incentive remaining to meet their payment needs. Will reducing the sales price be the most effective use of your incentives? If not, consider another strategy, as shown in this example scenario:

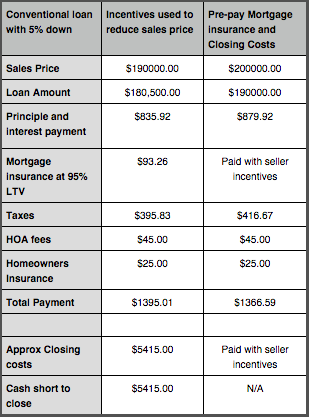

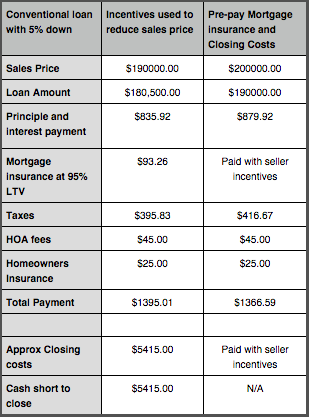

Mr. and Mrs. Smith like your Lynwood floor plan priced at $200,000. They need a payment under $1400 per month and they've saved $10,000 to buy a new home. They negotiated your price down to $190,000 using the full incentive of $10,000 in order to lower their payments. They have good credit and at least 6 month's reserves in a savings account. Learning this, a 5% down conventional loan can be used to calculate their payments and come up with a powerful way to close the sale!

Payment scenario the prospect proposes:

The challenge here is that the prospect does not have the funds needed to pay closing costs. So, it is up to us to show them a better solution that maximizes their savings and your incentives. Here, we might show them how we can prepay the mortgage insurance using our incentives, leaving enough incentive remaining to cover up to 3% of their closing costs! This can be shown by the sales price of $200,000, the loan amount of $190,000, the total payment of $1366.59, and of course, the closing costs paid by the seller!

In this example you see a better use of applying incentives and how that strategic application of financing can be used effectively to close the sale. Not only did we help the customer purchase the home they wanted, but we also sold it at a higher price, which helped support values for the builder. Do the math and use financing to sell more homes!

*Financing scenario using a $200,000 sales price, 30 yr. conventional loan at 95% LTV with a .62% MI factor, 2.5% tax rate, $45/mo HOA, $25 homeowners insurance, prepaid mortgage insurance at a cost of 2.25%, 3% closing costs, and $10,000 seller incentives.

Todd Condon is an experienced professional with an extensive background in sales management. Previously the Vice President of Sales for Ryland Homes, Condon currently resides in Chicago as New Home Star's Director of Sales for the Chicago division. He enjoys working in a team-focused environment and values "result-oriented" management.